- Section 179 Tax Deductions for Heavy Equipment

- What Kind of Equipment Qualifies for Section 179?

- Section 179 Works for Used Equipment?

- What Is Bonus Depreciation for Heavy Equipment?

- How Is Bonus Depreciation Calculated? (Example)

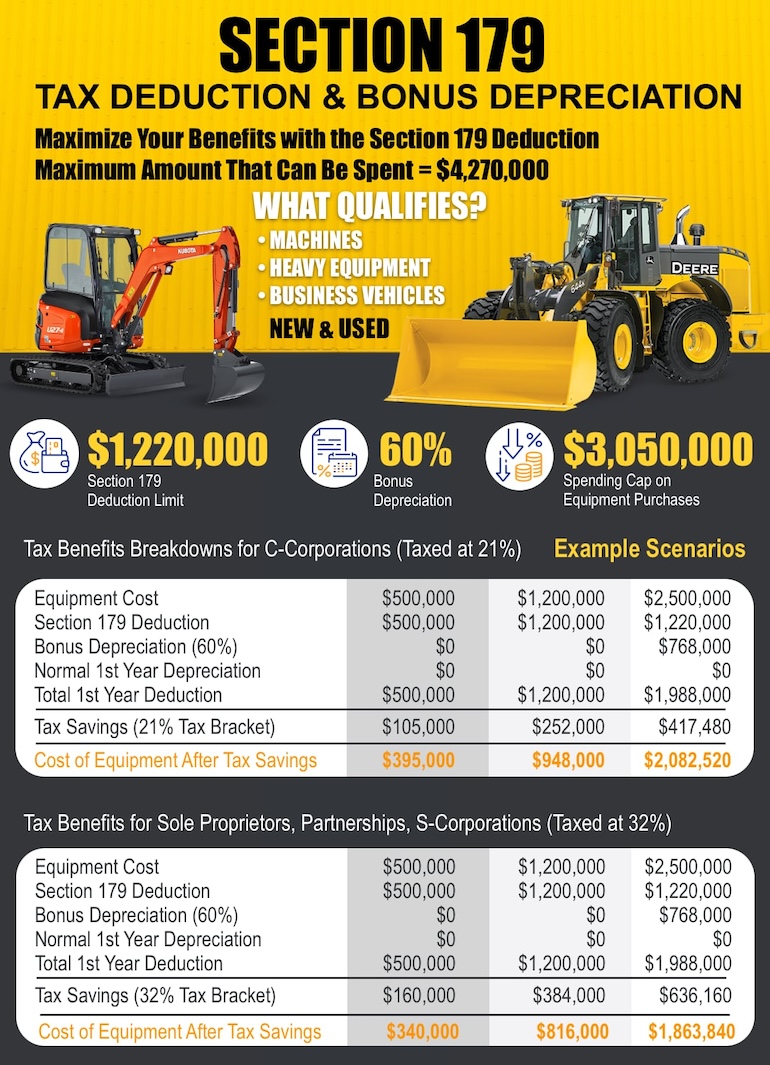

- Section 179 & Bonus Depreciation Infographic

- How to Nab Your Section 179 Deduction with IRS Form 4562

- Step 1. Purchase Qualifying Equipment

- Step 2. Use the Equipment for Business

- Step 3. Place the Equipment in Service

- Step 4. File Form 4562

- Step 5. File Your Tax Return

- Example Steps for Filing Form 4562:

When investing in construction equipment, it’s essential to consider the tax implications that could significantly reduce your costs. The Section 179 tax deduction and bonus depreciation are two powerful tools that can provide substantial savings on your heavy equipment purchases.This guide will walk you through how these tax incentives work and how to maximize your savings.

Section 179 Tax Deductions for Heavy Equipment

The Section 179 tax deduction allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. This provision encourages companies to invest in themselves by purchasing new or used equipment, which can be a significant financial advantage.

2024 Deduction Limit = $1,220,000 – This Section 179 Tax Deduction is good on heavy equipment. To take the deduction for tax year 2024, the equipment must be financed or purchased and put into service between January 1, 2024 and the end of the day on December 31, 2024

2024 Spending Cap on equipment purchases = $3,050,000 – This is the maximum amount that can be spent on heavy equipment before the Section 179 Deduction available to your company begins to be reduced on a dollar for dollar basis. This spending cap makes Section 179 a true “small business tax incentive” (because larger businesses that spend more than $4,270,000 on machinery won’t get the deduction).

2024 Bonus Depreciation = 60% – is generally taken after the Section 179 Spending Cap is reached. The Bonus Depreciation is available for both new and used heavy equipment.

| Year | Max Deduction | Spending Cap | Bonus Depreciation |

|---|---|---|---|

| 2021 | $1,050,000 | $2,620,000 | 100% |

| 2022 | $1,080,000 | $2,700,000 | 100% |

| 2023 | $1,160,000 | $2,890,000 | 80% |

| 2024 | $1,220,000 | $3,050,000 | 60% |

The passage of the Tax Cuts & Jobs Act (TCJA) in 2017 significantly changed the rules for bonus depreciation by allowing small businesses to immediately write off 100% of the cost of heavy equipment acquired and placed in service after September 27, 2017

What Kind of Equipment Qualifies for Section 179?

Qualifying equipment includes tangible property such as heavy equipment & machinery, vehicles, computers, and office furniture.

Specifically, for the construction industry, this encompasses a wide range of heavy machinery, including:

- Excavators: Used for digging and earthmoving tasks.

- Loaders: Essential for transporting materials around the site.

- Cranes: Vital for lifting heavy loads.

- Backhoes: Multipurpose machines used for digging and material handling.

- Bulldozers: Used for clearing and grading land.

- Motor Scrapers / Grader, Tracked Carriers, Trencher, etc.

It’s important to note that the equipment must be used more than 50% of the time for business purposes to qualify for Section 179.

Section 179 Works for Used Equipment?

Yes, Section 179 can be applied to both new and used equipment, provided the used equipment is “new to you.” This means that your business can benefit from the tax deduction even when purchasing pre-owned machinery, as long as it hasn’t been previously owned by your company.

This provision allows for more flexibility and affordability in acquiring necessary equipment, making it easier to manage budgets while still gaining the benefits of tax deductions.

What Is Bonus Depreciation for Heavy Equipment?

Bonus depreciation allows businesses to depreciate a significant portion of the purchase cost of qualifying assets in the first year they are placed in service. Unlike Section 179, which has a limit on the amount that can be deducted, bonus depreciation currently allows for a 60% (for 2024) deduction on qualifying new and used property, without any spending cap.

This can provide substantial tax relief, especially for large purchases. By carefully planning your equipment purchases, you can ensure that your business maximizes its tax benefits and improves overall financial health.

How Is Bonus Depreciation Calculated? (Example)

Example of $1,500,000 Equipment Purchase with Section 179 and Bonus Depreciation: to calculate the bonus depreciation for a $1,500,000 heavy equipment purchase in 2024, considering the Section 179 tax deduction, follow these steps:

- Apply the Section 179 deduction first:

- Section 179 deduction limit for 2024: $1,220,000

- Equipment purchase cost: $1,500,000

- Section 179 deduction amount: $1,220,000

- Calculate the remaining unadjusted depreciable basis after the Section 179 deduction:

- Remaining unadjusted depreciable basis = $1,500,000 – $1,220,000 = $280,000

- Apply the 60% bonus depreciation to the remaining unadjusted depreciable basis:

- Bonus depreciation amount = $280,000 × 0.60 = $168,000

- The remaining adjusted depreciable basis after the bonus depreciation is:

- Remaining adjusted depreciable basis = $280,000 – $168,000 = $112,000

- This $112,000 will be depreciated using the normal MACRS (Modified Accelerated Cost Recovery System) depreciation schedule over the asset’s useful life.

In summary, for a $1,500,000 heavy equipment purchase in 2024, the tax deductions would be:

- Section 179 deduction: $1,220,000

- Bonus depreciation: $168,000 (60% of the remaining $280,000 basis)

- Normal MACRS depreciation: Applied to the remaining $112,000 basis

Section 179 & Bonus Depreciation Infographic

It’s important to consult with a tax professional to ensure compliance with the latest tax regulations and to determine the specific impact on your business.

By understanding and utilizing Section 179 and bonus depreciation, your business can make substantial tax savings on new and used construction equipment. These incentives are powerful tools to help you invest in the necessary machinery to grow and improve your operations while managing your tax liability effectively.

How to Nab Your Section 179 Deduction with IRS Form 4562

To claim your Section 179 deduction, you need to follow a series of steps outlined by the Internal Revenue Service (IRS). Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying heavy equipment or financed during the tax year. Here’s how you can claim your Section 179 deduction:

Step 1. Purchase Qualifying Equipment

Ensure that the heavy equipment you are purchasing qualifies for the Section 179 deduction. Qualifying property generally includes:

Tangible personal property such as machinery, heavy equipment, and business vehicles with a gross vehicle weight rating over 6,000 pounds.

Step 2. Use the Equipment for Business

The heavy equipment must be used for business purposes more than 50% of the time. Only the portion of the expense used for business can be deducted.

Step 3. Place the Equipment in Service

The equipment must be purchased (or financed) and put into service by December 31 of the tax year in which you are claiming the deduction.

Step 4. File Form 4562

To claim the Section 179 deduction, you must fill out and attach IRS Form 4562 (Depreciation and Amortization) to your tax return. Here’s how to complete Form 4562:

Election to Expense Certain Property Under Section 179

- Line 1: Enter a description of the property.

- Line 2: Enter the cost of the property.

- Line 5: Enter the maximum Section 179 expense deduction (for 2024, this is $1,220,000, but the amount may change annually).

- Line 6: Enter the total amount of Section 179 property placed in service during the year.

- Line 7: Calculate the deduction limit based on business income.

- Line 11: Enter the smaller of the business income limitation (from line 5 or 7) and the total cost of Section 179 property placed in service during the year.

Step 5. File Your Tax Return

Include Form 4562 with your business’s tax return. If you are a sole proprietor, you will attach it to Schedule C. If you are part of a corporation, partnership, or LLC, include it with the relevant business tax return forms.

Example Steps for Filing Form 4562:

- Gather Your Receipts and Documentation:

- Keep records of the purchase date, amount, and proof that the property was placed in service.

- Complete Part I of Form 4562:

- Line 1: Describe the property (e.g., “office computers”).

- Line 2: Enter the total cost of the property.

- Line 6: Sum the costs of all Section 179 property.

- Calculate the Deduction:

- Follow the instructions on lines 7 through 11 to determine the amount you can deduct.

- Attach Form 4562:

- Attach the completed Form 4562 to your tax return and file by the due date (including extensions).

Be aware of the annual limits for Section 179 deductions. For 2023, the limit is $1,220,000, with a phase-out threshold of $3,050,000. Tax laws can change, so always check the latest IRS guidelines or consult with a tax professional. After applying the Section 179 deduction, you may also be eligible for bonus depreciation on any remaining cost.

By following these steps, you can effectively claim your Section 179 deduction and maximize your tax benefits for business equipment purchases.

Can my company apply the Section 179 deduction and/or bonus depreciation to financed construction equipment?

Yes, small business can save money by financing heavy equipment purchases, especially when the financing agreement allows them to benefit from Section 179 deductions. Consult with your tax advisor to find the financing option that best fits your company’s specific tax requirements.